Buy Gold Online in Switzerland: Guide to Prices, Trusted Dealers & Secure Shipping

Are you wondering where to buy gold online in Switzerland? Look no further; you are in the right place, and we’ve got you covered.

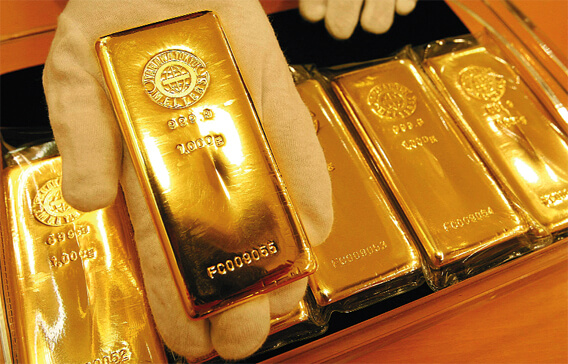

An investment in physical gold has been and will always be one of the perfect classics of financial investments for both small and large budgets.

There are gold bars and coins in very different denominations, from 1 gram of gold to 1 kilogram of gold, and they are an ideal gift for a wide variety of occasions.

It is possible to buy gold as a gift and also invest in the future of the recipient.

We have all kinds of qualities of gold, with the purest coming from some of the best sources worldwide. They are well refined and minted in some of the best mints in Switzerland.

For years, gold prices have proven to be the best in comparison to other investments. Investors who buy gold are able to protect their assets from excessive fluctuations in value as gold keeps appreciating over time.

Although gold prices or value are subject to fluctuations, they usually recover after some time, which is why even larger companies like central banks hold large gold reserves to take advantage of these properties.

Current 24K Gold Price per Gram in Switzerland

As of July 2025, the 24K gold price per gram in Switzerland is approximately CHF 55–57 (~$60), fluctuating with the global spot price. Swiss gold prices reflect minimal premiums due to the country’s status as a major precious metals trading hub. Investors value the transparency and liquidity of Swiss gold markets.

Prices update daily based on London Bullion Market rates and Swiss franc exchange rates, making Switzerland a reliable place for buying pure gold bars and coins.

22K and 18K Gold Prices in Switzerland: What Buyers Should Know

Swiss 22K gold prices hover around CHF 50–52 per gram, while 18K gold costs about CHF 41–43 per gram. 22K gold is popular for jewelry due to its balance of purity and durability, while 18K offers more affordability with greater scratch resistance. Both carry slightly lower premiums than 24K. Buyers should note that 18K and 22K are commonly used in Swiss-made jewelry and watches, impacting demand and price stability.

| Purity | Price per Gram (CHF) |

|---|---|

| 24K | 55–57 |

| 22K | 50–52 |

| 18K | 41–43 |

How Swiss Gold Prices Compare to Other European Markets

Swiss gold prices tend to be slightly lower or competitive compared to neighboring markets like Germany, France, and Italy due to Switzerland’s tax advantages and efficient trading infrastructure.

For example, VAT on investment gold is 0% in Switzerland, while other countries may charge VAT on certain gold products. Additionally, Swiss dealers offer narrow premiums.

This combination makes Switzerland attractive for buyers seeking competitive prices, easy resale, and high liquidity within the European gold market.

Gold Price Trends in Switzerland: What to Expect in 2025

In 2025, Swiss gold prices are expected to reflect global market volatility, influenced by inflation, currency fluctuations, and geopolitical factors. Experts forecast a steady to moderate upward trend, as investors seek safe-haven assets amid economic uncertainty.

Switzerland’s stable banking system and transparent market make it a consistent hub for gold trading. Buyers should watch for price spikes during crises but expect relatively stable growth, making it a good time for long-term investment.

How to Buy Gold Bars and Coins Online in Switzerland Safely

To buy gold online safely in Switzerland, choose reputable dealers with strong reviews and verified certifications. Always check for transparent pricing, secure payment options, and clear return policies.

Verify the authenticity guarantees and request official assay certificates. Use secure payment methods like bank transfers or credit cards. Confirm the dealer offers insured shipping with tracking to protect your investment from loss or theft during delivery.

Top Online Gold Dealers in Switzerland: Reviews and Ratings

Top Swiss online gold dealers include Valcambi, PAMP Suisse, and Swiss Gold Safe, known for their reliability and certified products. Valcambi and PAMP are world-renowned refiners offering bars and coins with assay certificates.

Swiss Gold Safe specializes in secure storage solutions. Review ratings emphasize trustworthiness, pricing transparency, and customer service. Always check recent customer feedback and accreditation from Swiss regulatory bodies before purchasing.

Payment Methods Accepted for Online Gold Purchases in Switzerland

Swiss dealers typically accept payments via bank transfer, credit/debit cards, PayPal, and sometimes cryptocurrency. Bank transfers are preferred for large transactions due to security and lower fees. Credit cards offer convenience but may include processing fees.

Ensure your payment method offers fraud protection. Always confirm payment details directly with the dealer to avoid scams. Reputable dealers provide encrypted checkout systems for secure online transactions.

Understanding Taxes and VAT When Buying Gold Online in Switzerland

Investment-grade gold (bars and coins with at least 99.5% purity) is exempt from VAT in Switzerland, making it more cost-effective. However, gold jewelry and collectibles may attract VAT.

Buyers should verify the purity and type of gold to understand tax obligations. Swiss dealers clearly state VAT status upfront. Importing gold from abroad may involve customs duties and taxes, depending on the shipment’s origin and value.

How Swiss Online Gold Dealers Ensure Secure Shipping and Insurance

Swiss dealers use tamper-evident packaging and trusted courier services like DHL or FedEx for secure shipping. Shipments are fully insured against loss, theft, or damage.

Tracking numbers provide transparency. Dealers often require signature on delivery and may offer discreet packaging to protect privacy.

This ensures your gold arrives safely and intact, giving buyers peace of mind when purchasing valuable bullion online.

What to Know About Importing Gold Bought Online into Switzerland

When importing gold into Switzerland, declare the shipment with customs if required, especially for large amounts. Switzerland’s customs policies favor investment-grade gold with minimal duties. Ensure your online purchase comes with certificates of authenticity and origin.

Keep invoices handy for customs verification. Working with dealers experienced in international shipping can simplify compliance and reduce delays or unexpected fees.

How to Store Gold Safely After Online Purchase in Switzerland

Safely store gold in a bank safety deposit box, private vault, or a high-quality home safe bolted to the floor. Ensure the storage location has insurance coverage for theft and damage.

Keep all purchase documents and certificates secure but separate from the gold itself. Regularly review your storage security and update insurance as needed. Professional vault services in Switzerland offer added security and convenience for larger holdings.

Why Swiss Buyers Should Consider Buying Gold Directly from Africa

Swiss buyers benefit from purchasing African gold due to lower premiums, direct sourcing, and ethical mining practices. African gold often sells closer to the spot price, saving buyers up to 30–40%.

Buying directly supports local communities and provides access to larger quantities and high-purity gold. Trusted suppliers like Buy Gold Bars Africa Limited offer certified, authenticated bullion with secure shipping to Switzerland, making this a lucrative alternative to traditional Swiss markets.

Comparing Swiss Gold Prices with African Gold Prices: Savings and Quality

Swiss gold prices include taxes and premiums, averaging CHF 55–57 per gram for 24K gold. African gold, sourced directly, can cost CHF 35–40 per gram, offering savings up to 30–40%. African gold is high purity and certified by professional assay labs.

Buying from Africa reduces dealer markups and VAT, making it an attractive option for Swiss investors and jewelers seeking quality bullion at competitive prices.

BUY GOLD AT AN AFFORDABLE PRICE DURING THESE TIMES.

You can buy gold during these volatile times associated with uncertainty. The precious metal gold has proven to be a safe haven against other items of investment and has fulfilled its role as a store of value.

Therefore, many investors across the world rely on gold, especially in times of crisis. For those who are considering capital preservation in contrast to short-term profit maximization, gold is an ideal investment. Right from the start of the Ukraine war, the demand for precious metals has never been higher, thus affecting the price.

That means you can get your hands on high-quality gold at a very competitive price in the market. For beginners who are yet unsure if they can delve into the market, they can split their investment amount and buy gold at different times.

Buy gold at this time, especially because of the Ukraine war, at the best price. Just contact us and get started with your lifetime investment.

African Gold Prices in Switzerland

|

Purity

|

Africa ($/oz)

|

UAE ($/oz)

|

|---|---|---|

|

24K

|

2,300

|

3,050

|

|

22K

|

2,100

|

2,800

|

|

18K

|

1,750

|

2,300

|

HOW TO BUY GOLD IN SWITZERLAND ONLINE?

Interested in acquiring high-quality gold in Switzerland discreetly? Look no further! Our online platform ensures a confidential and secure gold-buying experience.

Simply reach out to us through our Contact Us form, or WhatsApp: +256 707 585144 and our dedicated team will guide you through the process with the utmost confidentiality.

Whether you’re a seasoned investor or a beginner, we prioritize your privacy in the gold business. Start your inquiry today, and let us assist you in making a confidential and secure investment in top-notch gold.

How to Safely Import Gold from Africa to Switzerland

To safely import gold from Africa to Switzerland, verify the dealer’s credibility, ensuring Buy Gold Bars Africa Limited provides LBMA-approved assay reports for authenticity.

Use secure couriers like Brinks or Malca-Amit, offering insured, armored transport. Comply with Swiss FINMA regulations and customs declarations, requiring proof of origin and purity.

Obtain export permits from African countries like Kenya or Ghana, adhering to their mining and trade laws.

Avoid scams by checking certifications, avoiding cash payments, and using escrow services. Research dealers on Trustpilot, confirm serial numbers, and opt for Swiss vaults like GOLD AVENUE for secure storage post-import.

About Legality & Regulations for Importing Gold into Switzerland

Switzerland is one of the world’s leading gold trading hubs, with strict but business-friendly regulations on gold imports. If you’re importing gold from Africa into Switzerland, understanding the legal framework is essential to ensure compliance and avoid legal issues.

1. Importing Investment-Grade Gold

Switzerland exempts investment-grade gold (gold bars and coins with at least 99.5% purity) from Value Added Tax (VAT). However, customs authorities require documentation proving the gold’s purity and source.

2. Compliance with Anti-Money Laundering (AML) Laws

Gold imports must adhere to Swiss Anti-Money Laundering (AML) regulations. Buyers must provide proof of funds, seller information, and transaction details to avoid illicit gold trade. Swiss financial institutions conduct strict due diligence before processing payments for large gold transactions.

3. Import Duties & Taxes

- Investment gold: Exempt from VAT.

- Non-investment gold (jewelry, lower purity gold): Subject to 7.7% VAT.

4. Required Documentation

To legally import gold into Switzerland, you need:

- Certificate of Origin: Verifying the gold’s source (e.g., from Ghana, Tanzania, or South Africa).

- Assay Certificate: Confirms gold purity.

- Customs Declaration: Submitted to Swiss authorities (Federal Customs Administration).

5. Approved Import Routes & Licensed Dealers

Gold imports must be handled by licensed dealers registered with the Swiss Financial Market Supervisory Authority (FINMA). Buyers should work with approved refineries or vaulting services for compliance.

By following these regulations, you can legally and securely import gold from Africa to Switzerland while ensuring compliance with Swiss laws.

Shipping, Customs, and Import Taxes in Switzerland

Switzerland is a global gold hub, making it relatively straightforward to import gold, provided you follow the correct shipping and customs procedures. Understanding these regulations ensures a smooth and legal transaction.

1. Shipping Methods for Gold Imports

When importing gold from Africa to Switzerland, secure and insured shipping is crucial. The best shipping options include:

- Specialized Couriers – Companies like Brinks, Malca-Amit, and Loomis specialize in transporting precious metals securely.

- International Carriers – FedEx and DHL offer gold shipping but may have restrictions depending on the country of origin.

- Hand-Carry Services – Some high-net-worth individuals transport gold personally with customs clearance assistance.

2. Customs Clearance Process

Gold imports must be declared to the Swiss Federal Customs Administration (FCA) upon arrival. The importer must provide:

- Customs declaration form (confirming weight and purity).

- Certificate of Origin (proving the gold’s legal source).

- Invoice and proof of purchase (to verify the transaction details).

Failure to provide proper documentation can lead to gold confiscation or fines.

3. Import Taxes & Duties

- Investment-grade gold (99.5% purity or higher): VAT-exempt and duty-free.

- Non-investment gold (jewelry, gold below 99.5% purity): Subject to 7.7% VAT.

To ensure compliance, work with licensed gold importers and logistics companies to facilitate customs clearance. Proper planning and adherence to regulations will help you legally and securely import gold into Switzerland.

Tax-Free Gold Purchases in Switzerland

Switzerland’s VAT exemption on investment-grade gold (99.5%+ purity) makes it a prime destination for tax-free gold purchases, reducing costs compared to regions like the UAE, where a 5% VAT applies.

African dealers like Buy Gold Bars Africa Limited offer 24K gold at ~$2,300/oz, significantly lower than UAE’s ~$3,050/oz, due to lower production costs and no VAT in Switzerland.

Swiss buyers face no additional domestic taxes, but international buyers must consider their home country’s import duties or VAT (e.g., EU’s 20%).

Verify LBMA certifications and use secure couriers like Brinks to ensure safe, cost-effective purchases.

How to Verify Gold Authenticity and Avoid Scams

When buying gold from Africa for import to Switzerland, verifying authenticity is crucial to avoid scams. Follow these steps to ensure you’re dealing with genuine gold:

1. Request Proper Documentation

Legitimate gold sellers provide certificates of authenticity, export permits, and assay reports detailing purity and weight. Always verify these with government mining authorities.

2. Conduct Purity Tests

Use professional testing methods such as:

- Fire Assay (most accurate)

- XRF Spectrometer (non-destructive)

- Acid Test (quick purity check)Buyers can also verify gold by testing its weight and density against official standards.

3. Buy from Reputable Dealers

Avoid individuals offering “too good to be true” deals. Purchase only from licensed dealers, refineries, or trusted platforms with verified customer reviews.

4. Secure Transactions

Use escrow services, bank transfers, or secure payment methods rather than cash transactions to prevent fraud.

5. Verify the Seller’s Reputation

Check references, licenses, and reviews. Ask for recent trade history and proof of past transactions.

By following these steps, Swiss buyers can safely import genuine gold from Africa without falling victim to fraud.

How to Buy Gold Online Safely

To buy gold online safely, verify authenticity by requesting certificates and assay reports from LBMA-approved refiners like PAMP Suisse, ensuring 99.5%+ purity and serial number verification.

Use secure payment methods such as bank transfers or escrow services, avoiding cash or untraceable options. Check dealers’ compliance with Swiss regulations, including FINMA oversight and customs requirements for international purchases, to ensure legal and transparent transactions.

Reputable dealers like SD Bullion, APMEX, or Buy Gold Bars Africa Limited offer insured shipping and clear documentation.

Research reviews on Trustpilot, compare premiums, and opt for professional storage (e.g., Swiss vaults) to safeguard your investment.

How to Import Gold from Africa to Switzerland Legally and Safely

To import gold legally from Africa to Switzerland, obtain necessary export permits and certificates of origin from African suppliers. Comply with Swiss customs regulations and declare your shipment.

Use insured, trackable courier services. Partner with trusted dealers like Buy Gold Bars Africa Limited who provide full documentation and assist with customs paperwork. Proper documentation ensures smooth clearance, avoids fines, and guarantees your gold’s authenticity and legal status.

Storage

For storage, Swiss vaults like GOLD AVENUE and SuisseGold.com offer top-tier security and privacy. GOLD AVENUE provides VAT-free, fully allocated storage with instant buyback, while SuisseGold.com ensures segregated storage in Zurich, adhering to Swiss privacy laws. Both use Malca-Amit’s high-security vaults, protecting assets from theft and geopolitical ri

Frequently asked questions (FAQs) about gold in Switzerland:

1. Why is Switzerland a popular place to buy and store gold?

- Switzerland is renowned for its stability, secure banking system, and well-established gold market. The country has a long history of neutrality, financial security, and low taxes, which make it an attractive destination for gold investors looking for safe storage and purchasing options.

2. Do I have to pay VAT on gold in Switzerland?

- No, gold is exempt from VAT in Switzerland. This applies to gold in the form of bars, coins, or bullion. Switzerland follows a similar approach to other countries in the European Union when it comes to treating gold as an investment product rather than a commodity subject to VAT.

3. What types of gold are commonly traded in Switzerland?

- Commonly traded gold in Switzerland includes gold bars (often in 1 oz, 10 oz, and 1 kg weights), as well as gold coins like the Swiss “Vreneli,” the American Eagle, and the Canadian Maple Leaf. Investors also often buy gold-backed exchange-traded funds (ETFs).

4. Can I buy gold online in Switzerland?

- Yes, you can buy gold online from a range of reputable dealers in Switzerland. Many Swiss companies offer gold bullion and coins through their websites, and they often provide secure payment and insured shipping options. It is important to choose a well-established and trusted dealer.

5. How do I store my gold in Switzerland?

- Switzerland is home to some of the world’s most secure gold vaults. Many investors choose to store their gold in vaults managed by private vault companies or Swiss banks. Swiss vaults are known for their high level of security, privacy, and discretion. You can also store gold at home in safes, but many prefer to use professional storage solutions.

6. Are there any taxes on gold in Switzerland?

- While gold is exempt from VAT, if you sell gold and make a profit, you may be subject to capital gains tax, depending on the circumstances. However, if you are selling gold in a private transaction (not as a business), there are typically no taxes on the sale in Switzerland. Always check with a tax advisor for personal guidance.

7. Is it safe to buy gold in Switzerland?

- Yes, Switzerland has a well-regulated and secure gold market. The Swiss government regulates precious metals trading, and Swiss banks and vaulting services are among the safest in the world. Always ensure you buy gold from reputable dealers with strong customer reviews and proper certifications.

8. Can foreigners buy gold in Switzerland?

- Yes, foreigners are allowed to buy and own gold in Switzerland. The country does not impose restrictions on foreign ownership of gold, making it a popular choice for international investors. You do not need to be a Swiss resident to purchase or store gold in Switzerland.

9. How do Swiss gold dealers set prices?

- Gold prices in Switzerland are typically set based on the global spot price of gold, which fluctuates daily based on market conditions. Swiss dealers generally add a premium to the spot price to cover handling, shipping, and other associated costs.

10. What is the role of Switzerland in the global gold market?

- Switzerland is a major player in the global gold market. The country has some of the world’s largest gold refineries (like PAMP and Argor-Heraeus), and Zurich is a key hub for gold trading and financial services. Switzerland also plays a central role in gold storage and distribution.

11. Can I sell gold in Switzerland?

- Yes, you can sell gold in Switzerland through gold dealers, banks, or specialized precious metal buyers. The country has a well-established market for buying and selling gold, and you can usually get a competitive price based on the current spot market rate.

12. How can I ensure the authenticity of gold in Switzerland?

- When buying gold in Switzerland, it is important to verify that the dealer provides certification and assay reports for the gold. Most Swiss gold bars and coins are stamped with the manufacturer’s logo and a serial number. Reputable dealers will provide certificates of authenticity or assay cards.

13. Can I invest in gold-backed financial products in Switzerland?

- Yes, Switzerland offers a variety of gold-backed financial products, including ETFs, structured products, and gold savings accounts. These allow investors to gain exposure to gold prices without physically owning the metal.

You may also like;